💡 Welcome to Your Financial Wellness Resource Hub!💡

Explore a collection of roadmaps, templates, and helpful PDFs designed to kickstart your financial wellness journey. Whether you’re focused on credit building, debt management, or budgeting, you’ll find tools that fit your needs.

Looking for fresh insights? Dive into our curated list of blogs, podcasts, and expert resources—and keep an eye out for regular updates!

Ready to begin?

Scroll down to start with our educational resources and listen to some podcasts!

Ready to dive in?

Resource Library

Educate

Financial advice is everywhere—on social media, YouTube, podcasts, and blogs.

While these platforms can be great for inspiration and discussion, they are ultimately entertainment—not official sources of financial truth. The people sharing advice on these platforms are interpreting information, often adding their own opinions, biases, and personal experiences.

Before making financial decisions based on what you hear online, it’s important to start with the facts. The resources below come directly from the experts—government agencies, regulatory bodies, and financial institutions that set the standards. Reviewing these materials first will help you build your own understanding of key financial topics, so you can recognize solid advice and avoid misinformation. Get informed, stay empowered, and make decisions with confidence.

1. FICO

🔗 FICO

What it is: FICO is the industry standard for credit scoring, helping lenders assess borrowers’ creditworthiness. Your FICO score is one of the most important factors in securing loans, mortgages, and credit cards.

How to use it: Use FICO’s official site to understand how credit scores work, what impacts your score, and how to improve it. Take advantage of their free educational tools and periodically check your score through approved sources to track your financial health.

2. IRS (Internal Revenue Service)

🔗 IRS

What it is: The IRS is the U.S. government agency responsible for collecting taxes and enforcing tax laws. It provides official guidance on tax filing, deductions, credits, and policies.

How to use it: Visit the IRS website for free tax tools, calculators, and guides on tax planning. Use their interactive forms to determine eligibility for deductions and credits, ensuring you file correctly and maximize your tax benefits.

3. CFPB (Consumer Financial Protection Bureau)

🔗 CFPB

What it is: The CFPB is a U.S. government agency that ensures consumers are treated fairly in the financial marketplace. It provides resources on credit, loans, debt, and financial rights.

How to use it: Use the CFPB’s website to access tools like mortgage calculators, budgeting worksheets, and complaint resolution services. Their educational guides can help you make informed decisions about banking, borrowing, and avoiding financial scams.

4. FDIC (Federal Deposit Insurance Corporation)

🔗 FDIC

What it is: The FDIC protects consumers by insuring deposits in U.S. banks and ensuring the stability of the banking system. It also provides educational resources on financial literacy and fraud prevention.

How to use it: Check the FDIC website to verify if your bank is insured and learn about your rights as a depositor. Their Money Smart program offers free financial education for consumers of all ages, helping you manage money safely and effectively.

5. Federal Reserve

🔗 Federal Reserve

What it is: The Federal Reserve (or “the Fed”) is the central bank of the United States, responsible for monetary policy, interest rates, and financial stability. It plays a crucial role in shaping the economy.

How to use it: Use the Federal Reserve’s website to track interest rate changes, read economic research, and understand how monetary policy affects your personal finances. Their educational resources help you stay informed on inflation, borrowing costs, and long-term financial planning.

6. SEC (Securities and Exchange Commission)

🔗 SEC

What it is: The SEC regulates financial markets, ensuring transparency and fairness in stock trading and investments. It protects investors from fraud and misconduct.

How to use it: Before investing, use the SEC’s EDGAR database to research public companies and check for any regulatory actions. Their investor education section provides beginner-friendly resources on stocks, bonds, and retirement planning.

7. FINRA (Financial Industry Regulatory Authority)

🔗 FINRA

What it is: FINRA is a non-governmental organization that oversees brokerage firms and protects investors from unethical financial practices. It regulates securities firms and provides dispute resolution services.

How to use it: Use FINRA’s BrokerCheck tool to verify the credentials of financial advisors and brokers before working with them. Their educational materials help investors understand risks, fees, and market trends before making investment decisions.

8. U.S. Department of the Treasury

🔗 U.S. Department of the Treasury

What it is: The Treasury Department manages federal finances, oversees national economic policy, and issues government bonds. It plays a key role in financial stability.

How to use it: Visit their site to track national debt, learn about savings bonds, and understand fiscal policies that impact taxes and government spending. Their resources on financial security and economic trends can help with long-term planning.

Entertain

Finance can be complicated (and let’s be honest—sometimes a little dry), but that doesn’t mean learning about it has to be boring! This section is all about fun and engaging interpretations of financial topics, making it easier to digest key concepts. Whether through podcasts, YouTube videos, or social media influencers, these creators take complex information and break it down in a way that’s relatable and easy to understand. However, it’s important to remember that these sources are interpretations, not always official facts. Everyone has their own perspective, and sometimes, personal opinions, biases, or even mistakes can slip in. Before acting on any advice you hear online, do your due diligence—cross-check information with trusted educational sources to ensure it’s accurate. Entertainment can be a great starting point, but real financial confidence comes from knowing the facts.

YouTube

-

The Money Guy Show

Bring confidence to your wealth building with simplified strategies from The Money Guy. Learn how to apply financial tactics that go beyond common sense and help you reach your money goals faster. Make your assets do the heavy lifting so you can quit worrying and start living a more fulfilled life.

-

George Kamel

George Kamel is a personal finance expert, #1 National Bestselling Author, and co-host of The Ramsey Show and Smart Money Happy Hour. Following Ramsey’s proven money plan, George went from negative net worth to a millionaire in under 10 years. His goal is to help people spend less, save more, and avoid money traps so they can live a life with more margin, options and freedom.

-

Clever Girl Finance

Empowering women to ditch debt, save money and build real wealth! Clever Girl Finance® is a financial media/education platform aimed at providing women with financial guidance and empowerment.

Don’t worry, this page also gives applicable advice for men too!

Podcasts

-

How to Money

How To Money is a podcast & website providing the knowledge & tools that normal folks need to thrive in areas like debt payoff, DIY investing, & crucial money tricks that will provide continuous help along your journey. We believe that access to free, unbiased, and jargon-free personal finance guidance is more necessary than ever before.

-

Planet Money

Wanna see a trick? Give us any topic and we can tie it back to the economy. At Planet Money, we explore the forces that shape our lives and bring you along for the ride. Don't just understand the economy – understand the world.

Check out episodes to learn how headlines are shaping your finances.

-

Your Rich BFF

Your Rich BFF is a personal finance channel created by Vivian Tu, a former Wall Street trader turned educator. The content breaks down money topics like saving, investing, career growth, and wealth building into clear, practical guidance that actually makes sense. This is finance without jargon, shame, or hype, just tools you can use in real life. If you want to feel more confident and in control of your money, this is a great place to start.

Engage

Now that you’ve explored and absorbed key financial concepts, it's time to put that knowledge into action. This section is all about applying what you've learned—turning insights into decisions, strategies into habits, and information into real financial progress. Whether you're building a budget, improving your credit, or planning for the future, taking action is what makes financial wellness more than just an idea. Here, you'll find practical steps and tools to help you move forward with confidence, using your knowledge to create lasting financial stability.

Learning is just the first step—now it’s time to apply what you’ve learned! This section is packed with hands-on resources to help you turn knowledge into real-world progress. You'll find a roadmap to guide your journey, fillable worksheets to track your goals and habits, and a comprehensive Excel workbook to put your new financial skills to the test.

These tools are designed to help you take control of your finances in a structured, practical way. Whether you’re budgeting, planning for the future, or improving your credit, working through these exercises will give you the confidence to take action. Start exploring and see how far you can go!

Our Free Wellness Roadmap and Workbook

While we encourage you to meet with a financial wellness counselor at least once, we understand you may want to navigate your own path.

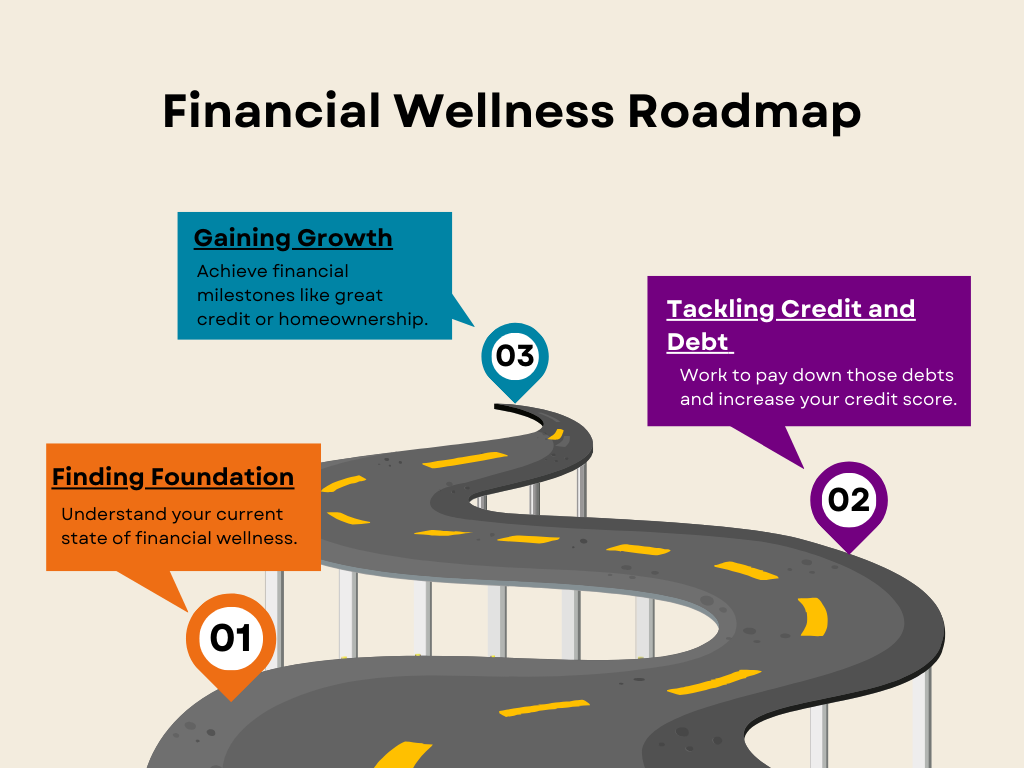

Our worksheets are designed to guide you through each stage of the Financial Wellness Roadmap above. Each worksheet builds on the next to create a Wellness Workbook that allows you to track the miles you trek. Remember to record your progress at least once weekly to grow strong financial habits. Work through each sheet individually or scroll down to use the advanced workbook.

TO BEGIN:

1. Click here to become familiar with these frequently used financial terms.

2. Below, click on Your Action Plan in the orange box or scroll to the bottom for a more advanced workbook.

3. Click here to learn how to download these fillable worksheets to your phone’s home screen.

Finding Foundation

1

Review your plan to better understand the journey you’re about to take. Take note of the action steps and milestones at each stage.

Now that we understand the journey let’s choose your destination. What are your wellness goals?

It helps to start by listing your current payment obligations. Use this worksheet to list every bill you have to pay every month.

Use this budget sheet to predict where you will spend the rest of your income after you make all your payments.

It’s time to group your expenses so we know how much is being spent in each category.

Are your spending habits in line with the predictions you made in your budget?

Tackling Debt and Credit

2

Stay motivated by tracking your payments and watching your debts shrink!

Once your debt is under control, learn how you can utilize credit as an asset.

3

Gaining Growth

Congratulations on completing the Wellness Workbook!

Consider booking a 1-1 coaching session with the wellness team to discuss your next financial wellness milestone!